This series of five GRG Remuneration Insights deals with General Employee Equity Plans (GEEPs) which are made available to most full-time Australian employees, and some part-time employees, and often operate on a salary sacrifice basis with matching by the company. There are four basic GEEP types. This Insight provides an outline of the main design features of the $5,000 Salary Sacrifice Share Plan (SSSP).

GRG Remuneration Insight 109

by Chris Godfrey & James Bourchier

Contributors: Denis Godfrey, Nida Khoury & Peter Godfrey

27 November 2018

This is one of a series of GRG Remuneration Insights dealing with general employee equity plans (GEEPs), also called employee share ownership plans (ESOPs). These plans are made available to the majority of full-time employees (and part-time in some cases); and often operate on a salary sacrifice basis with matching by the company.

GRG undertook extensive research in to market practices in relation to GEEPs and have published the outcomes in GRG Remuneration Insights available on a complementary basis on this website.

There are four basic GEEPs:

- Share Save Plan (SSP) – this Insight 109,

- $5,000 Salary Sacrifice Share Plan (SSSP) – see Insight 110,

- After Tax Employee Contribution Plan (ATECP) – see Insight 111, and

- $1,000 Tax Exempt Plan (TEP) – see Insight 112.

This GRG Remuneration Insight provides an outline of the main design features of the SSP.

Modelling Assumptions

The model used to illustrate the operation of the plan is based on the following assumptions which were designed to simplify calculations:

- Share price at commencement is $2.00,

- Share price grows at 14.5% per annum,

- Share price after year 3 of $3.00,

- Cash Dividends are declared each year and represent a yield of 4%,

- Dividends are 50% franked,

- Company tax rate of 30%,

- Employee marginal tax rate (including Medicare Levy) of 39% unless otherwise indicated,

- Salary Sacrifice Plan Shares and Matching Plan Shares are acquired at commencement,

- Holding period of 3 years following which the shares are sold, and

- Dividends are applied to acquire more shares which are also sold after the first 3 years.

Only the first year’s acquisitions are used in the model. However, additional holdings will further accumulate if a participant continues to add to their 1st year acquisitions.

Plan Features

The following represents a typical plan design, however many design aspects are flexible and can be changed to meet a company’s requirements:

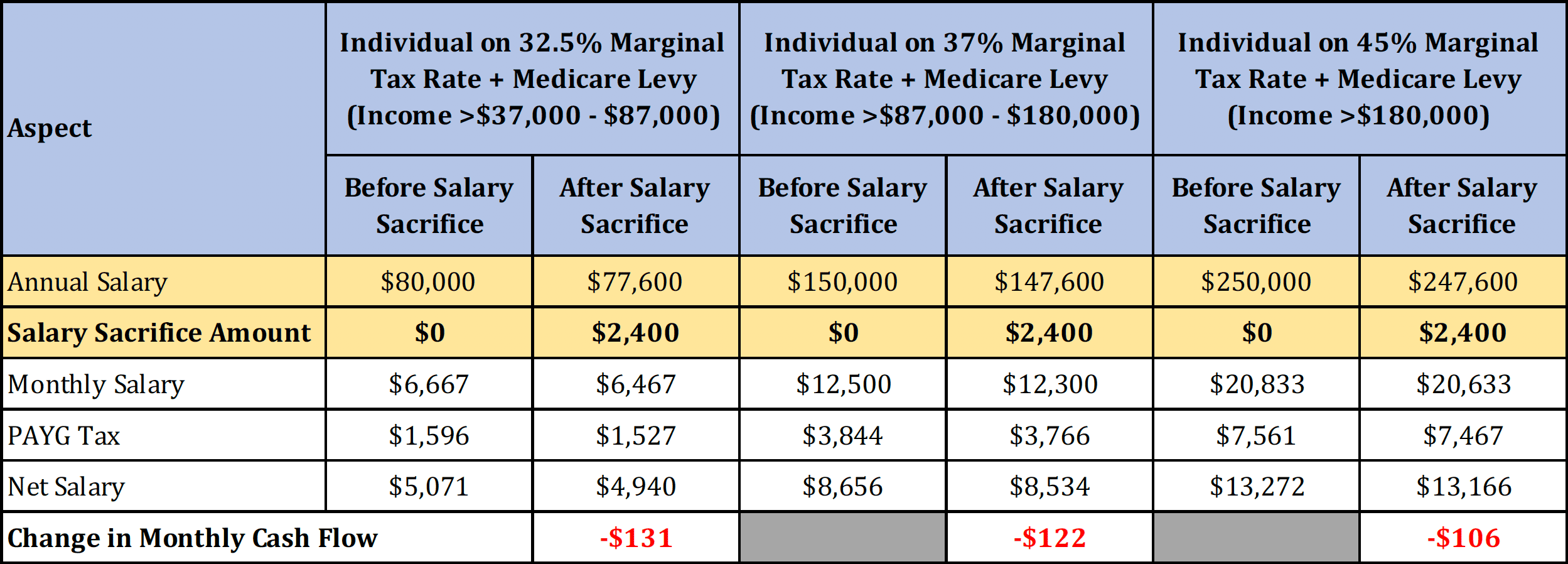

- Employees apply to join the SSP and nominate the amount of salary to be sacrificed each pay period. As an example, the following table shows the amount of net salary that will be forgone to fund a salary sacrifice of $200 per month for a year (i.e. pre-tax).

- The amount of salary sacrifice is converted into Plan Shares.

- The Acquisition Price of each Plan Share is the volume weighted average price (VWAP) at which Company Shares were traded on the Australian Stock Exchange (ASX) over the period of the salary sacrifice. Over the first year the participant will have acquired 1,200 Plan Shares ($200 x 12 months ÷ $2.00).

- The Company provides Matching Plan Shares that vest after 2 years of service on a one for one basis. Thus, after the first year the participant will have been granted 1,200 Matching Plan Shares.

- Dividends are reinvested into additional Plan Shares.

- If the Participant leaves the Plan Shares in the SSP and continues to Salary Sacrifice, the number of Plan Shares held within the SSP will continue to grow.

- The taxing point arises at the earlier to occur of:

- Withdrawal of Plan Shares,

- Cessation of employment with the company, or

- Elapse of 15 years from the acquisition of the Plan Shares.

- After three years the participant will have accumulated 2,835 shares which are sold for a value of $8,506 netting $5,189 (after tax is deducted) based on an initial salary sacrifice amount of $2,400.

- An optional design feature is that employees can be protected from loss in relation to Salary Sacrifice Plan Shares from a fall in the share price (with no additional cost to the company) if at the time of withdrawal the share price is less than the acquisition price.